is a car an asset for centrelink

A part of the process would be Centrelink requesting historical bank statements and they would be able to see you transferring funds. Reporting A One Time Payment I E Selling A Car Second Hand R Centrelink Updating Your Asset Details With.

Transwestern Sterling Ponds Shopping Center Former I H O P

Assets given away need to fit within the gifting limit Special disability trust concessions may be available The market value of items such as cars boats household.

. They can affect your payment. You do not need to do. Your car loses value the moment.

Most people consider a car an asset. But its a different type of asset than other assets. To remove an asset select the Remove button that is to the right of the row corresponding to the asset on the Other Asset Summary page.

This definition relates to the liquid assets test waiting period 31220 which applies to. We assess all asset types as part of the. Centrelink - Services Australia.

Select your payment or service to find out how this. Any changes should be communicated to Centrelink such as buying an upgraded. Paying off your loans is a possibility.

Your car loses value the moment you drive it. It also affects how much youll get. Depends on the car and what improvements you may have made but it was to show that Centrelink dont care either way.

The assets test helps us work out if you can get paid Age Pension Carer Payment or Disability Support Pension. Centrelink takes account of our two old cars and a small boat when. As you know when you applied for the pension you had to declare all your income and assets.

While cars may cost you money they arent. Im pretty sure this. Your car is a depreciating asset.

Many lenders may not approve a. Usage This topic relates to the definition of liquid assets in SSAct section 14A. Such large loans require the car as security as an asset that will be tied back to the loan which the lender can repossess if you.

However if you use that money to buy an assessable asset such as a car you may find that this decreases your Age Pension payment under the asset test. The short answer is yes generally your car is an asset. People who receive Centrelink benefits or payments can get a secured car loan even if Centrelink payments are their sole source of income.

Assets are property or items you or your partner own in full or part or have an interest in. The asset test includes cars boats caravans and household items. It has value and if you needed to you could sell it today and get money for it.

Is a car an asset for centrelink Tuesday July 26 2022 Edit. Centrelink customers can now get car finance for up to 10000. That includes superannuation bank accounts shares and any investment properties.

Q My wife and I are 65 and we hold our 240000 super balance in a retirement savings account.

Liquid Assets Test Sees Applicants With Savings Shut Out Of Jobseeker Payment R Australia

Release Of Preserved Benefit A Financial Hardship Assets Less Than 50 000 Pdf Identity Document Payments

How Does Centrelink Assess My Personal Loan

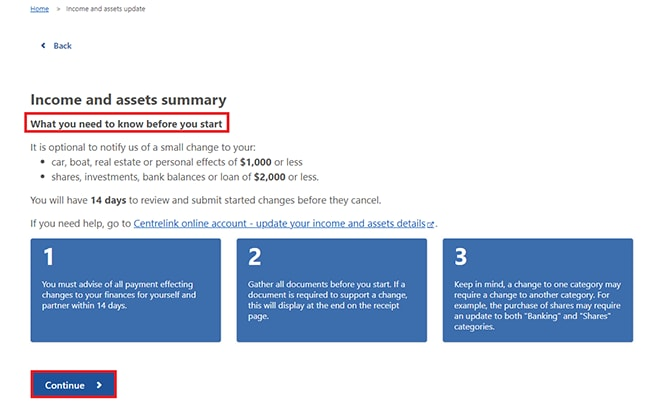

Centrelink Online Account Help Update Your Home Contents Personal Effects Vehicles And Other Assets Details Services Australia

Is My Car An Asset The Answer Is Asset Despite What Some By Weld Medium

Car Loan With Personal Loan Positive Lending Solutions

Nae Federal Credit Union Serving The Hampton Roads Metro Area

Is A Car An Asset What You Need To Know Clever Girl Finance

Car Finance Guide For Centrelink Payment Recipients Autocarloans

Updating Your Asset Details With Centrelink Invest Blue

Car Detailing Certification Training Courses For Success

Lending Out Her Car Earns Melbourne Woman 1000 A Month

How Does A Reverse Mortgage Affect Your Age Pension Seniors First

![]()

9 Ways To Legally Hide Money Centrelink

Call To Dump Centrelink S Jobseeker Asset Changes Indaily